Spread

Ohio Markets offers highly competitive spreads across both major and minor currency pairs. In particular, the average EUR/USD spread can be as low as 0.1 pips, positioning it among the most competitive in the global trading market.

Competitive Pricing Across Platforms

Our pricing model aggregates liquidity from over 25 institutional liquidity providers, ensuring consistently low spreads and deep liquidity availability throughout the trading week (24/5)

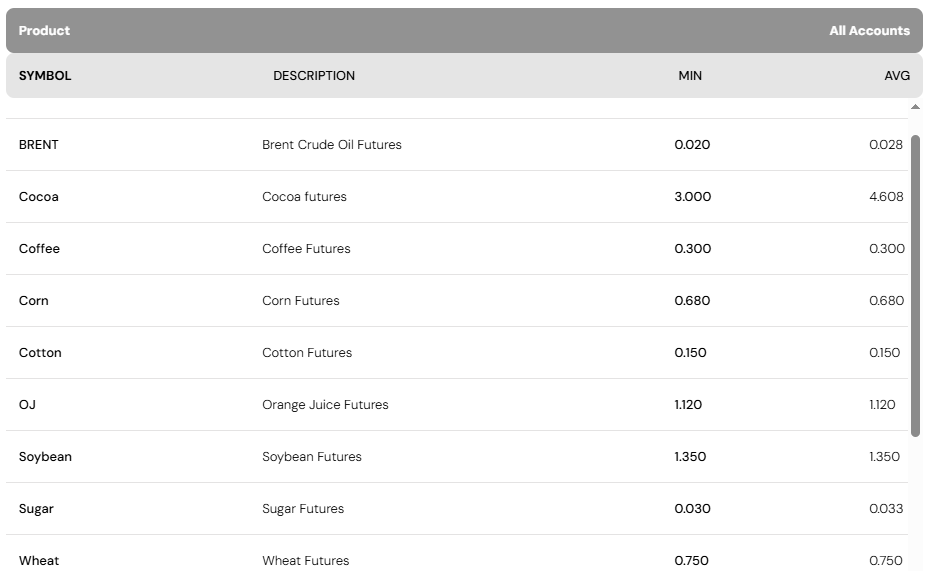

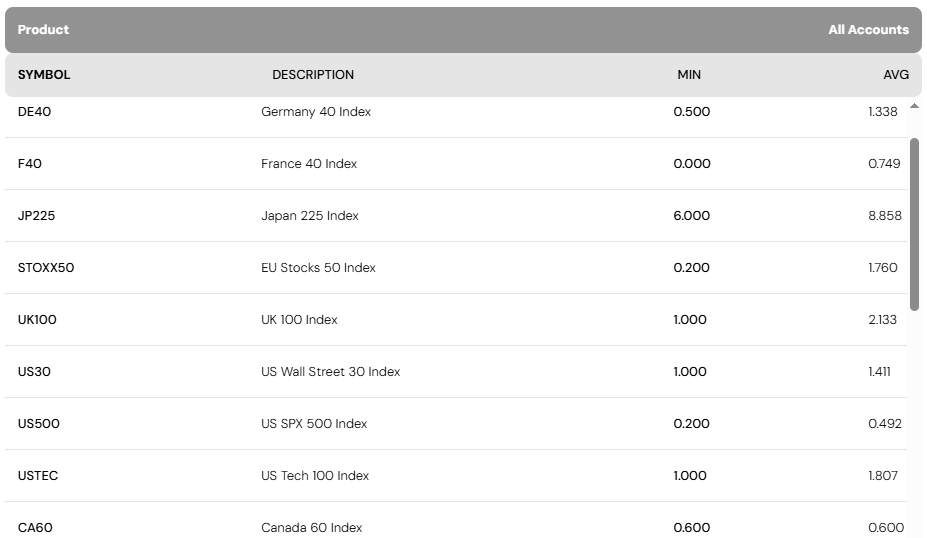

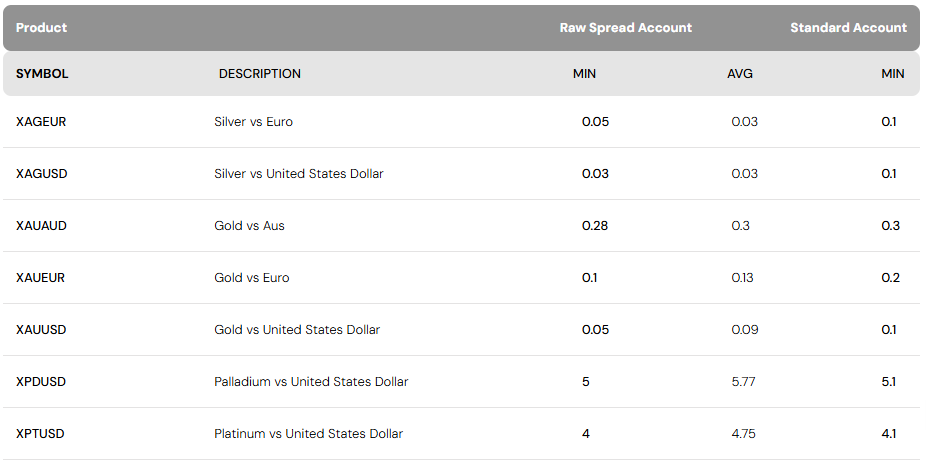

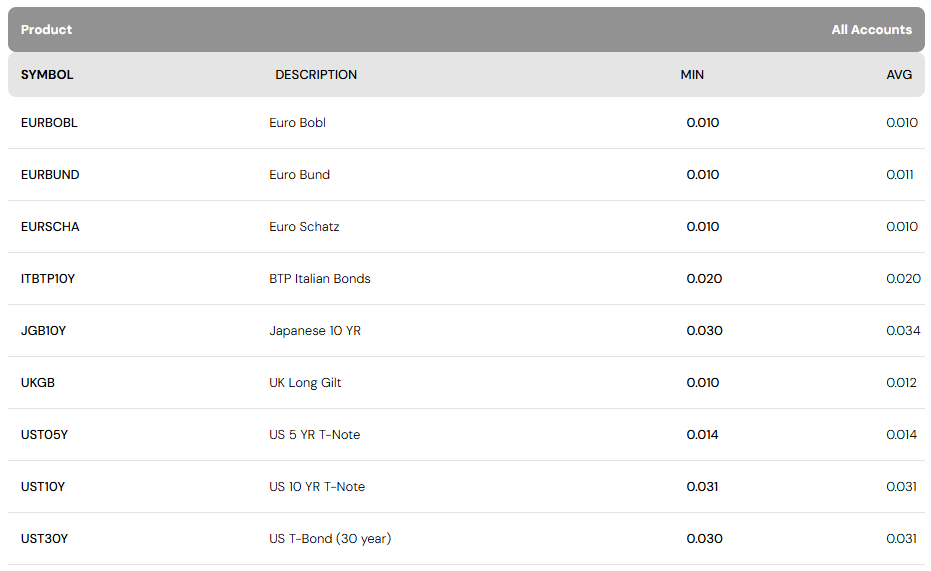

Spreads

Why does spread matter?

The spread in Forex refers to the difference between the ask and bid prices of a currency pair. It’s how brokers make a profit, and it represents your trading cost. A tight spread means lower trading costs, giving you more value for every trade you make.

How spread affect to your trades?

Experienced traders know that spread changes can significantly impact trading decisions. Keeping a close eye on spread fluctuations is essential, as even slight changes can influence your profitability.

What Are High Spreads?

High spreads often signal low liquidity or high market volatility. For example, non-major forex pairs typically have wider spreads than major pairs due to lower trading volume. At Ohio Markets, we ensure that our spreads remain competitive, even during volatile periods.

What Are Low Spreads?

Low spreads usually reflect high market liquidity or low volatility. This often occurs during major Forex sessions when trading activity is at its peak. At Austin Pips, we take advantage of these conditions to offer you consistently tight, low-cost spreads.

What is Spread in Forex?

In Forex trading, the spread is the difference between the bid price (the price at which you can sell a currency) and the ask price (the price at which you can buy it). Measured in pips, the spread represents the cost of entering a trade, making it a key concept for every trader to understand.

For example, if the EUR/USD is quoted at 1.1251/1.1252, the spread is 0.0001, or 0.1 pips. In USD-based pairs, pip values are typically measured at the fourth decimal place. Traders calculate the cost of the spread by multiplying the pip value by the number of lots traded. For instance, on a standard lot of 100,000 units, a 1-pip spread would cost $10. If your account is denominated in another currency, like GBP, the amount should be converted accordingly.

Fixed vs. Variable Spreads

It’s important to distinguish between fixed and variable spreads:

Fixed spreads remain the same regardless of market conditions.

Variable spreads fluctuate with market supply and demand, usually narrowing during calm, liquid periods and widening during high volatility or low liquidity.

Traders who trade less frequently may prefer fixed spreads for predictability, while active traders often benefit from variable spreads, especially during peak trading hours.